The TLDR on Structured Prodcts 📉📈

The one-liner on the brochure might read something like:

"Structured products are made up of several equity, commodity, FX, and interest rate derivatives packaged with senior unsecured debt to provide investors alternative investment vehicles to help them meet and exceed their financial goals."

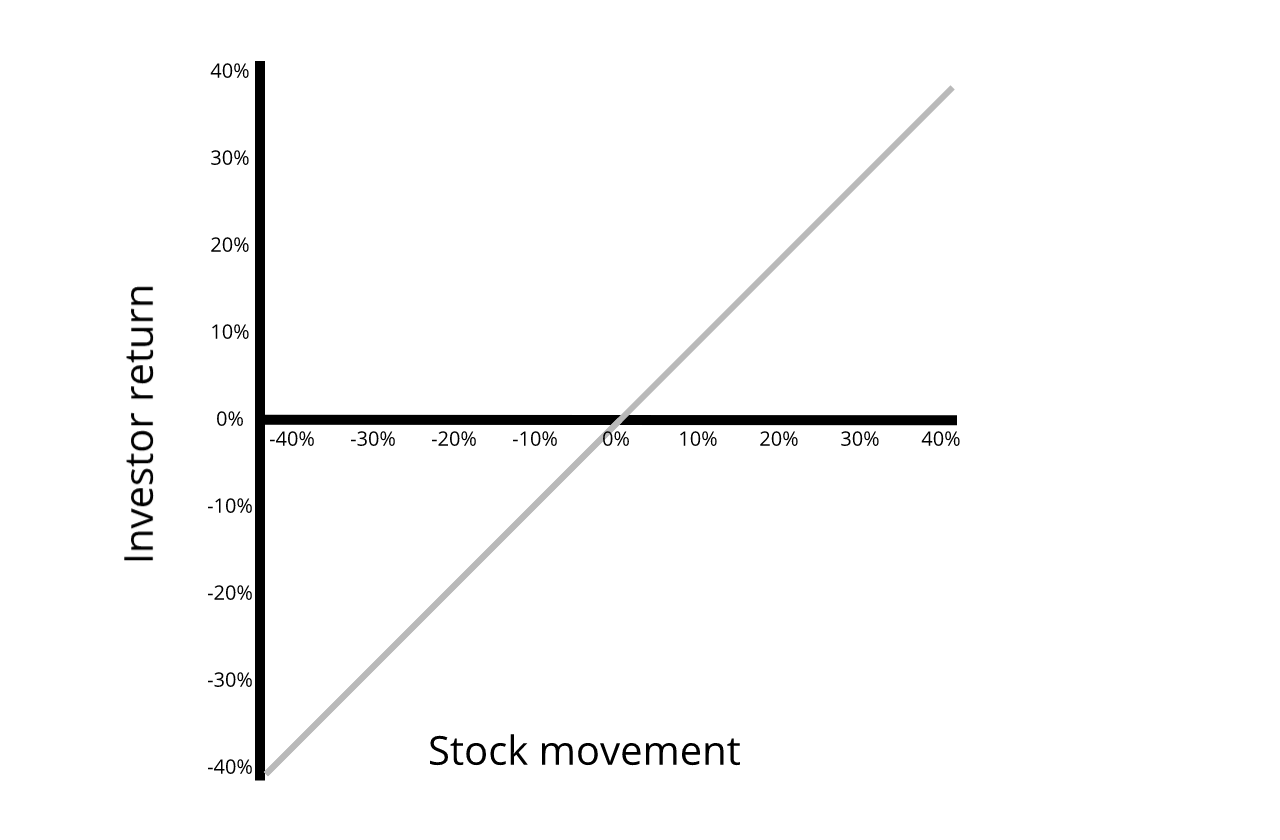

Right? What the heck does all that even mean? Here's how I typically explain it. Lets take a more normal investment, such as buying 1 share of Apple Inc. (aapl). If you bought that share when Apple was at $100, and then it goes up to $105, you as an investor made a 5% return. Apple stock went up 5%, you made 5%. This is a linear payoff. The investment went up 5%, you made 5%. That payoff looks like this:

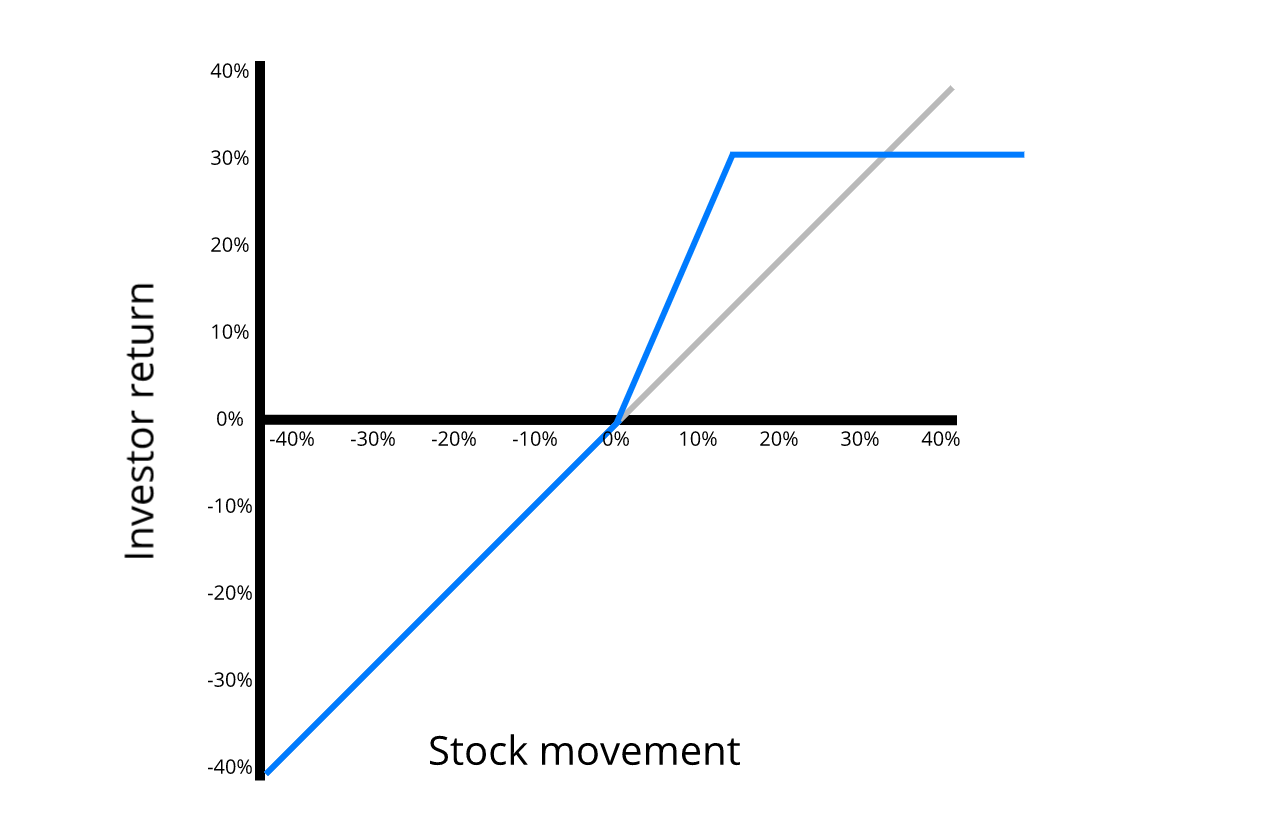

Now, back to structured products. By doing some super complicated and magical financial sorcery, we created products that turned that linear payoff into something more exotic like this:

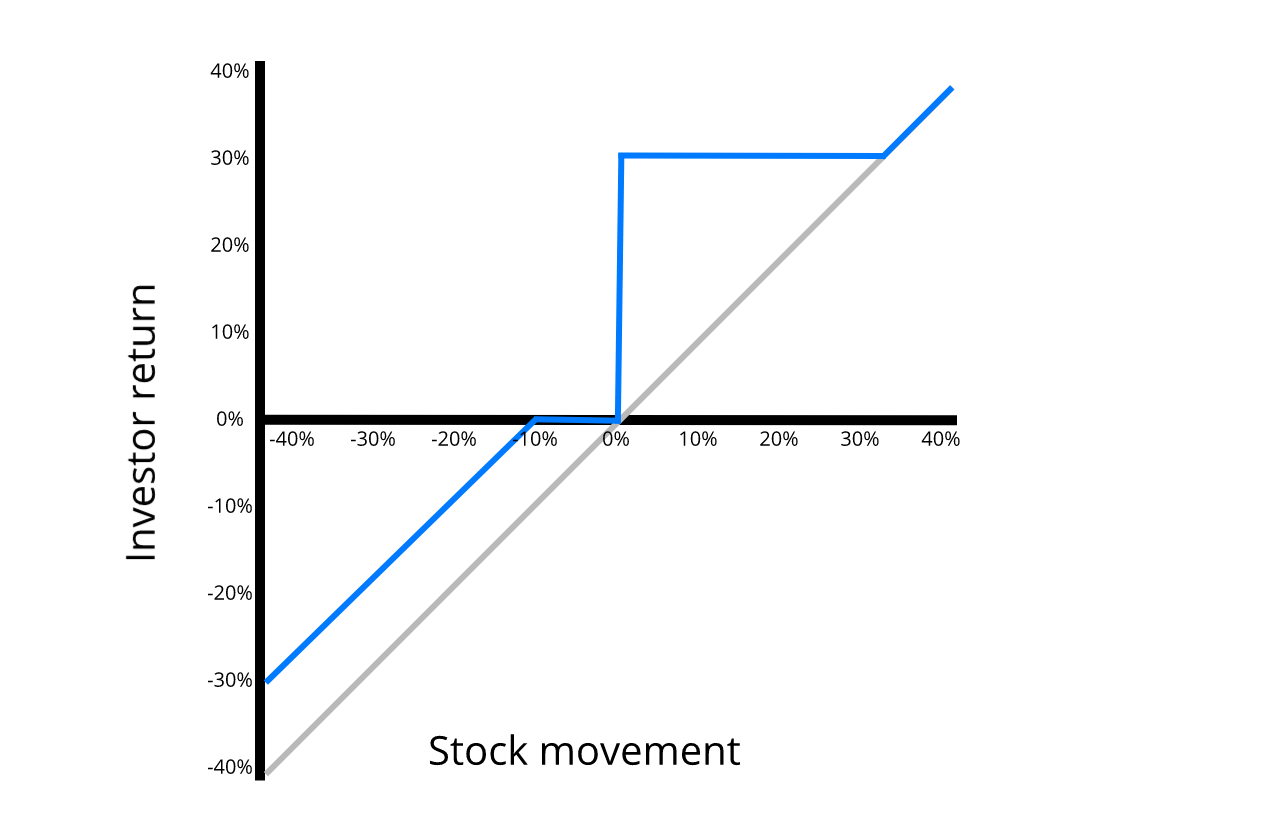

or this:

Now if Apple went up 5%, you could make 15%. Or if Apple was simply up by any amount you could make at least 30% while having 10% downside protection. Pretty cool, right?

These are hypothetical examples and do not reflect actual products or investment advice.